Remember the Lesson of the last “G” Cycle: Patience Is Indeed a Virtue

February 28, 2023 | The past few days, I used the weekend to clean out my office. This is always such a ‘fun’ (and funny!) exercise as I typically find myself going down the rabbit hole of memories after finding a note from my kids or a picture from when they were young. This time I found something that gave me a different type of pause. Specifically, I uncovered what is pictured here at the bottom of a drawer dating back to my time as an analyst. As the picture shows, I unearthed a McKinsey & Co whitepaper titled: “Are telcos ready for the 5G future?” The date of this report? February 2019.

I then, not surprisingly, got off track with my cleaning and sat for a bit to page through this analysis. When you think of all that has happened since this date (four mid-band spectrum auctions, the close of the Sprint / T-Mobile merger, the rise of DISH as the 4th national player, and oh yeah, a global pandemic!), I was genuinely curious to see how McKinsey’s predictions had held up four years later.

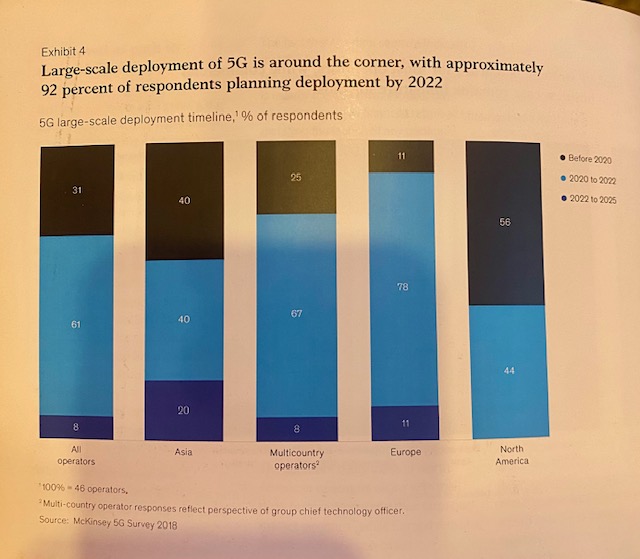

The whole report made for an interesting read but the one chart that was most noteworthy to me is highlighted below. The chart summarizes the answers from 46 different global operators when asked the question: “When do you anticipate ‘large-scale’ 5G deployment?” Respondents were given three answer options: 1) before 2020, 2) 2020-2022, and 3) 2022-2025.

The bar on the far right of this chart shows the answers of the North American carriers. Amazingly 56 percent of the operators estimated that large-scale 5G deployment would be complete BEFORE 2020 (so essentially in the 10 months after the publication of this report). And the remaining 44 percent of those interviewed thought it would be done in the period between 2020 – 2022. What is most interesting is all other carriers in Non-US geographic regions who were interviewed (namely Asia and Europe) took a much more conservative outlook in terms of timing; with each region having some operators estimate the timing of 5G scale deployment to be between 2022 – 2025.

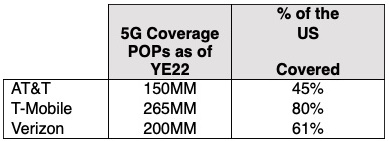

Like much of any historical look back shows us, many of the original predications proved to be overly optimistic. The chart below summarizes where the main three US national players were in 5G POPs covered with mid-band spectrum (the base foundation for any 5G ecosystem) and high-band spectrum as of year-end 2022. As can be seen below, the furthest carrier along with 5G deployment is T-Mobile with 265MM POPs covered (or ~ 80 percent of the US population) with its “Ultra Capacity” 5G (note: Ultra Capacity 5G as TMO defines it is a network which includes dedicated mid- and/or high-band 5G signals).

While this chart shows the carriers still have a lot of lifting to do to get to a ‘large-scale’ 5G deployment, the lessons of 4G should not be ignored here and teach much about the importance of patience.

Stating the obvious, much of the delay in 5G deployment these past four years is due to two huge factors (both beyond the carriers’ control): Covid and spectrum. Covid does not need any explanation of course, but spectrum might. In 2019, the world did not fully accept the view that mid-band spectrum would become the global standard for 5G deployment. As this began to be accepted, the FCC saw the need to release more mid-band spectrum into the hands of the carriers. In the last four years, they did this through four spectrum auctions: Auction 105 (CBRS), Auction 107 (C-Band), Auction 108 (2.5GHz) and Auction 110 (3.45GHz). While the US remains still behind many other countries in terms of mid-band spectrum availability, the gap has narrowed and now is (finally) “5G go time!”

Despite this, there still remains much skepticism about the actual revenue model around 5G. This is where the patience point comes in. I remember as an analyst there was always a saying “Wall Street has a short memory.” This can be good news or bad news depending on the situation. But for 5G revenue opportunities, investors should remember what played out in 4G. Before 4G came, there was no Uber, there was no DoorDash, there was no Lyft….the list goes on and on. The point is, there needed to be a “build it and it will come” patience with 4G which seems to be lacking right now in any 5G discussion.

After finding this McKinsey report, I began to re-read the carriers’ Q4’22 earnings transcripts to see what the analysts were asking about the 5G revenue models. There was a lot of focus on Fixed Wireless Access (FWA) but very little talk about what models are yet to emerge. To be fair, if any one analyst were to say:“[Mike, John, Hans], in two sentences what is the 5G revenue opportunity? Go!” I am not sure they could answer with much specificity because we do not yet know what models will emerge….just as we did not prior to the rollout of 4G. However, as we know, new models DID emerge, more wildly than anyone could ever have guessed (much to many a taxi driver’s dismay).

So, like most things in life, with 5G deployment, patience is indeed a virtue. Going back to that chart in that February 2019 McKinsey report, while carriers’ timing may have been a bit off, the confidence they had then about ‘large scale’ 5G deployment has only gotten stronger now based on what we heard from their Q4’22 earnings reports.

Here are a few “money quotes” (all from the most recent quarter) to offer evidence of this view.

Hans Vestberg – CEO of Verizon – “In the shift to 5G, we have been rapidly building out our C-Band spectrum with the most aggressive deployment plan in our company's history…. Scaling of new business such as private 5G networks and edge computing will also be a strategic focus in 2023. Our family is strong and we're making the proper investment to ensure such services provide a meaningful contribution to future growth in the years ahead”

Neville Ray – President of Technology, T-Mobile – “We continue to pile in spectrum assets on 5G. I mean, we’re a 5G business. We’re trying to commit our spectrum, our entire portfolio to 5G as fast as we can. Why? Because it’s delivering just a tremendous experience to our customers…..That’s a big part of the program as we move through in 2023.”

John Stankey – CEO of AT&T – “Turning to 2023, what’s our strategy? Well, simple….. our North Star remains solely focused on becoming the best connectivity provider with 5G and fiber.”

Bottom line: the key for carriers with this “G” is to find a way where they can participate in more of the revenue touchpoints for these new models that have yet to develop. Even though Uber would not have emerged without 4G, the carriers did not economically benefit from this creation of this new model, even though their 4G capital spend enabled it.

However, that was then, and this is now. Based on the above commentary, the need to extract revenue opportunities out of this 5G capital investment is fully understood by the respective C-Suites. While they may approach it in different ways – they all do have their eyes on the prize. Now it is time to watch how the race plays out from here.

And in case you are wondering, my office is still not organized!

Our Latest Research

- U.S. 5G Revenues, 2023-2028: How much and where are mobile consumers spending?

- U.S. Mobile Data Forecast, 2023 – 2028: Onward upward

- U.S. Mobile Connections Forecast, 2023-2028: 5G dominance

- U.S. Mobile Network Infrastructure Spending Forecast, 2022-2027: 5G network...

- U.S. Mobile Consumers and 5G: Awareness and Interest

- U.S. Mobile Broadband Use by Time of Day: 2019, 2021, 2022 and 2023

by Graphite Design